Why I Froze My Credit

In this article I will explain why I froze my credit and convinced others I know to do the same!

Just after work on a recent Friday night, I got a call that seemed legitimate—at first. The caller ID said it was Bank of America. The person on the line said they were checking on a loan I had just started with a branch office in Texas. That instantly raised red flags. I knew I hadn’t applied for any loan, let alone with Bank of America.

I told the caller that, and that’s when they thought they dropped the bomb: they rattled off what they thought was my Social Security number. Now I was positive this was a scam.

Then they told me they needed to transfer me to another department. That’s when I hung up. My instincts finally caught up with me.

What followed were 6 to 8 calls from different numbers, all with Bank of America listed on the caller ID. I didn’t answer any of the calls. None of them left a message. I looked up each of the numbers and found that they all were, in fact, Bank of America numbers. At that point, I knew I was being targeted in a sophisticated phishing attempt.

Why Freezing Your Credit Matters

I’ve written many articles about phishing scams. I know how they work. But these folks nearly got me. That just-after-work timing when things can’t easily be checked? It’s a classic trick—catch people tired and off guard.

After trying and failing to get past the AI answering systems at Bank of America (which ironically asked me to verify my identity with the same Social Security number I was trying to protect), I finally got through to a real person’s line and was able to leave a voicemail. I followed up again after the weekend and eventually got a call back from a gentleman. He indicated my voicemails had been forwarded to him to investigate the matter so I was comfortable he was actually from Bank of America He verified no loan had been taken out in my name. That was a huge relief. I did suggest to him that there be a way on their website to notify the bank in such cases so one can get past the artificial intelligence (AI) guard dogs they have preventing human customer service.

In the meantime, I did something I now recommend to everyone: I froze my credit at all three major credit bureaus—Equifax, Experian, and TransUnion. I convinced my wife to do the same.

Here’s why:

Freezing Your Credit Is Free—and Smart

According to a November 2022 article in Real Simple (yep, I saved the issue), freezing your credit is one of the best ways to protect yourself—even if your identity hasn’t been stolen.

It keeps thieves from opening accounts in your name. And if you ever need to open one yourself, you can temporarily “thaw” your credit online in just minutes.

It’s free to freeze and unfreeze your credit. You just have to do it with each of the three bureaus. Think of it as locking the door when you leave the house. You may never have a break-in, but you’re safer because you locked up. Here are links to the 3 credit companies. You can put the freeze on for free (they WILL try to sell you various plans but you do not need to purchase anything at all to place the freeze):

-

-

- Equifax – navigate to: https://my.equifax.com/consumer-registration/UCSC/#/personal-info and sign in.

- Experian – navigate to https://www.experian.com/help/login.html and either sign into your account or click on the “Sign up for free” button.

- TransUnion – navigate to https://www.transunion.com/ and scroll down the page and click on the “Credit Freeze & Unfreeze” box. Fill out the form to create a free TransUnion Service Center account.

-

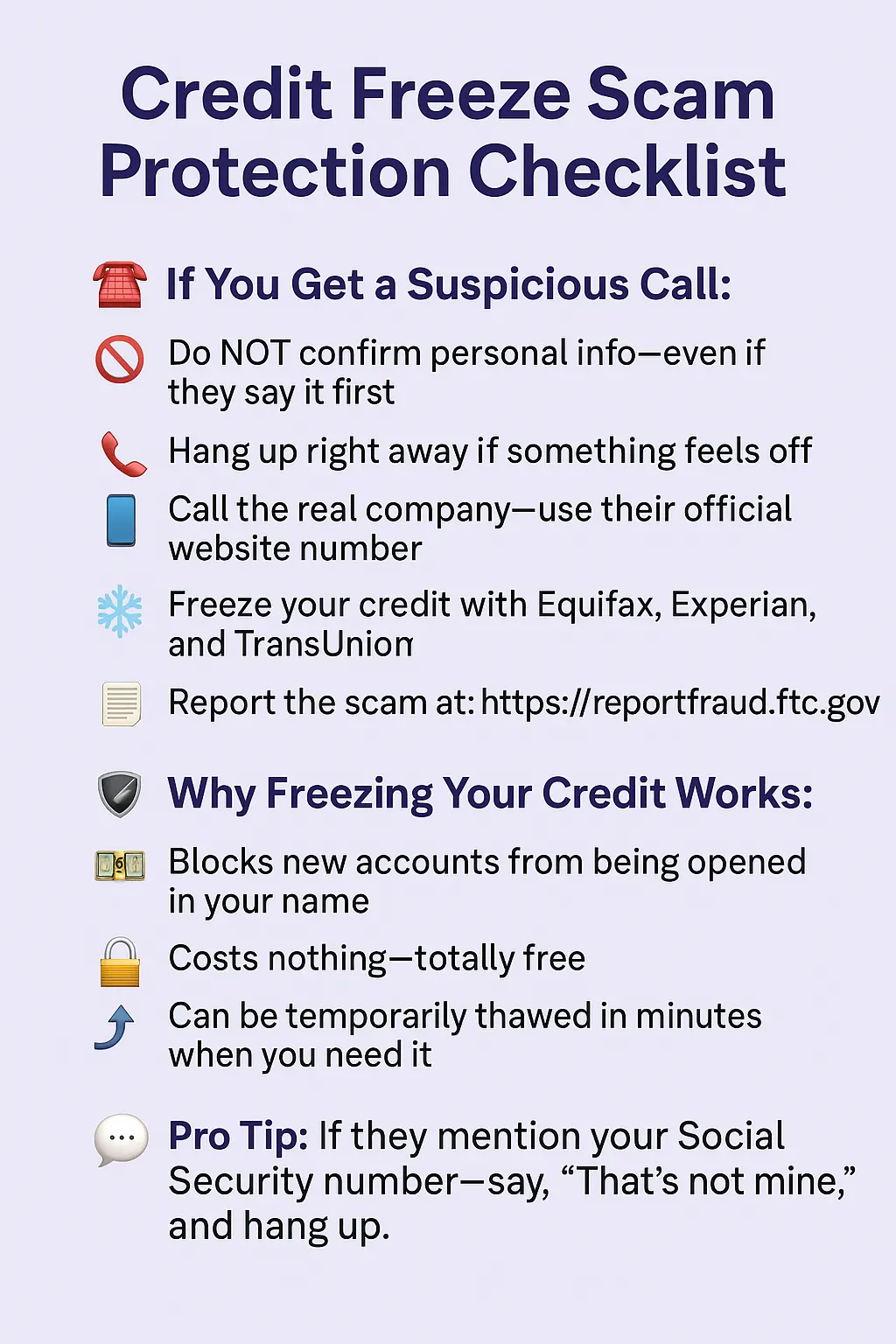

What to Do if You Get a Suspicious Call

If you get a call like I did, here are the best practices I learned the hard way:

-

-

- Don’t confirm any personal information—even if they say it first.

- Hang up immediately. If anything sounds off, trust your gut.

- Call the real institution directly. Use the number on their official website—not the one from caller ID.

- Freeze your credit. It’s a simple but powerful step

- Report the attempt. The FTC has an easy reporting form at https://reportfraud.ftc.gov.

- Say “That’s not my Social Security number,” and hang up. They may be left unsure if they have valid information.

-

Is Identity Theft Insurance Worth It?

The article I mentioned earlier touched on this as well. If you become a victim of identity theft, the average out-of-pocket cost in 2021 was $200—not thousands. Insurance can help you recover that and save time fixing things, but it won’t prevent identity theft in the first place. In my case, our State Farm homeowner policy (through Jarica Mazerall, InsuranceByJarica.com 603-420-8901) covers us. So while it’s not a bad idea, it’s not a must-have either. Freezing your credit is the first and best defense.

We all like to think we’re too savvy to fall for a scam. But these crooks are good. Trust me: really good! And they know exactly when and how to strike. Don’t wait until you’re shaken! I froze my credit and urge you to freeze your credit now—it’s one of the easiest and smartest ways to protect yourself and your family.